INTRODUCTION

Management accounting is to be done to gather information related to the accounting aspects. Most companies follow management accounting systems to generate effective information. In the presented report Dell company has been taken which follows the management accounting system. The given report describes the meaning of management accounting, its types and methods. The benefits of applying management accounting have also been presented. The absorption costing and marginal costing have also been described. Different planning tools and their application for forecasting budgets has been explained. The solutions to the financial problems of management accounting have been given in this report.

TASK 1

1.1 Management Accounting and Types of Management Accounting Systems

Management Accounting:

The bases of Management Accounting are financial accounting and cost accounting. It is the systematic process of analysing, measuring, interpreting and presenting the accounting information which has been collected through financial accounting and cost accounting. This helps in taking decisions, policy creation and day-to-day or routine operations of an organisation by the management. (Kaplan and Atkinson, 2015) The information related to the cost of products or services purchased by the company that used by the management accountant.

Types of Management Accounting Systems:

There are four types of Management accounting. These are as given below:

- Traditional cost accounting

- Lean accounting

- Throughput accounting

- Transfer pricing

- Traditional cost accounting:- In traditional cost accounting the calculation is done which includes the direct cost of raw material, labour and overhead. There is a cost driver which causes the cost to occur, such as direct material hours, direct labours and machine hours. (Simons, 2013)

- Lean accounting:- Lean accounting is the term which is generally used for changes made in a company's accounting, controlling, measurement and management processes (Fullerton, Kennedy and Widener, 2014). This supports lean manufacturing and lean thinking.

- Throughput accounting:- Throughput accounting is completely new in management accounting. It is based on the principle and approach of simplified management. It provides support for decision-making in the context of the company's profitability improvement.

- Transfer pricing:- In a simple sense, transfer pricing means the price which arises when the transfer of goods or services takes place between the holding to subsidiary company or from the subsidiary to the holding company.

Need to Consult Directly With Our Experts?

Contact Us1.2 Methods for Management Accounting Report

Tools and techniques which are used in management accounting are as follows:

-

Financial planning: Financial planning gives proper directions to the activities for well-performing. The major objective of any organisation is to earn maximum profits. And this objective is fulfilled by doing proper and sound financial planning.

-

Financial statement analysis: In this profit and loss account and balance sheet are to be prepared on a comparative basis for knowing the financial position of the company. This is to be done on a yearly basis means after at end of every accounting period.

-

Cost accounting: Cost accounting is to be done for analysing the data related to cost. It shows the data of cost according to product, process, department, branch and the like (Gibassier and Schaltegger, 2015). The actual costs are to be compared with the standard ones. This comparison shows the deviation if any and helps to management for taking decisions for the differences.

-

Fund flow analysis: Fund flow analysis gives the overview of the transfer of funds from one period of time to another. In this funds from operations and working capital changes are to be calculated. It also provides information with a comparison to the previous year on whether the funds are properly used or not.

-

Cash flow analysis: This analysis gives information related to the outflow and inflow of cash in the organization (Cooper, Ezzamel and Qu, 2016). It includes three activities: operating activities, investing activities and financing activities.

-

Ratio analysis: Ratio analysis shows the organisation's financial performance in several key areas which helps in comparative analysis with the previous year.

1.3 Advantages and Uses of Management Accounting System

Advantages of Management accounting:

- Increase efficiency- Management accounting increases the efficiency of operations. For evaluation and comparison of performance is accurate because everything is done with a scientific system.

- Profit maximisation using budgetary control and capital budgeting tools of management accounting organisations can easily reduce operating costs and capital expenditures. And by this company can earn super profits.

- Simplify the financial statements- With the help of various managerial decisions, the management accountant can generate technical reports in a simple and easily understandable way.

- Control of cash flow- One of the advantages of this is that it gives control over the cash flows of the company (Fullerton, Kennedy and Widener, 2013). The accountant can deal with the incoming and outgoing of money and also can control over if there is any misuse of money.

- Critical decisions of business- Management accounting is more power in taking critical business decision-making. This can be done at global level.

Uses of Management Accounting:

- Record keeping-

- Business transactions are to be recorded

- The result of financial changes is to be measured

- Financial effects of future transactions are to be projected

- An internal report is to be prepared in user-friendly format

- Planning and controlled-

- Cash collecting

- Stocks can be controlled

- Expenses are to be controlled

- Performance is to be monitored and coordinated

- Gross margins have to be monitored

- Decision making-

- For pricing, capital investment and marketing information of cost is to be used

- Market and product profitability can be evaluated

- The financial effects of strategies and plans are to be evaluated

TASK 2

P3 & M2

D1 Evaluation of how management accounting systems and management accounting reporting are integrated within organisational processes in the context of Dell

Management of Dell is using various management accounting techniques for reporting. There are various techniques that can be used by the management of Dell for better planning and organising so that they can achieve their targets in available limited financial and non-financial issues(Kaplan and Atkinson,2015). Other than this they also need to manage better organisational control so that various departments of Dell can coordinate with each other and they collectively achieve sustainable development.

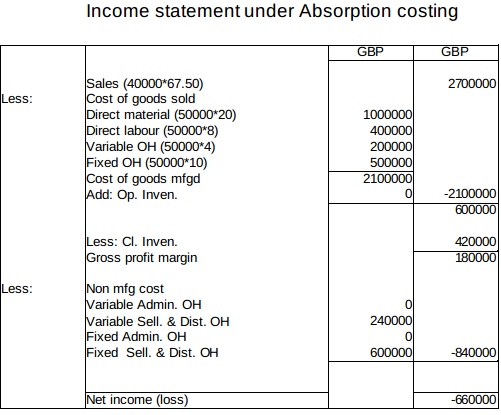

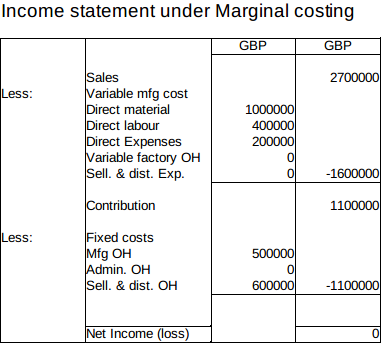

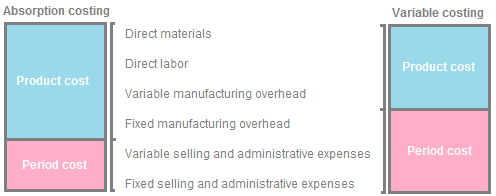

D2 Interpretation of data from Financial reports

As per the calculated data, if the company 'Dell' go with the absorption costing method then there will be a loss of 660000, in which the fixed cost of production is included. Whereas if the company go with the marginal costing then there will be the situation of no profit and no loss. Marginal costing is also called variable costing.

TASK 3

3.1 Explain the advantages and disadvantages of different types of planning tools used for budgetary control

Budgetary control is a process in which different tools are used through which an organisation can make plans and they can do forecasting for their proposed project(Renz, 2016). They can employ their available resources in a way so that they can get a better return on available funds. There are numerous planning tools which can be used by Dell and its management in managing their funds. In preparation for budget, Dell has certain objectives which are mentioned below :

- It defines the ultimate objective of Dell.

- Through budget management of cited entity can provide plans to achieve desired objectives it.

- Through budget, they can generate coordination between various departments of Dell

There are certain advantages as well as there are certain disadvantages of planning tools which are used for the preparation budget(Tappura and et.al., 2015). These advantages and disadvantages are mentioned below :

Stuck with your Assignment?

Hire our PROFESSIONAL ASSIGNMENT WRITERS and Get 100% Original Document on any Topic to Secure A+ Grade

Get Assignment Help

Advantages

- The goals and objectives of the cited entity can be defined easily. Because they need to make efforts in accordance with the target.

- Through it cited entities can easily fix their targets for a certain period. They can form short-term as well as long-term targets through the preparation of budgets.

- It can help the management of Dell to cut down the cost of production.

Disadvantages

- Budget preparation includes research and analysis which clearly means there is involvement of cost in the preparation of the budget(Sulaiman, Ramli and Mitchell,2016). Hence it becomes tough for small business enterprises to prepare a budget.

- Budgeting and its planning tools make the organisational system more rigid and less flexible hence employees who are working in the cited entity may feel more stressed.

3.2 Use of different planning tools and their application for preparing and forecasting budgets in the context of Dell

There are different planning tools which can be used for the preparation of a budget so that cited entities can forecast their projects. Forecasting provides a prediction of future projects through which they can take better steps in the achievement of various organisational goals and objectives. There are certain planning tools which can be used for making an analysis of different factors and for making a budget :

- Variance Analysis: it is a quantitative investigation of the difference between actual results and budgeted output. Through it, organisations can investigate which factors are responsible for variances(EBRAHIMI and MOGHADASPOUR,2015). When the management of Dell prepares their budget they estimate the output of that budget as per certain estimations which need to be estimated on some scientifically approved basis so that they can be reliable.

- Ratio Analysis: Ratio analysis is made by analysing the financial statements of the cited entity on the basis of certain scientifically approved ratios so that stakeholders of Dell can get better information about it. Through such a ratio which is scientifically approved stakeholders like employees, suppliers, shareholders, customers local government etc. can make better decisions regarding Dell.

- Financial Analysis: Financial statements and their analysis can be helpful for the management of the cited entity in forecasting as after assessing the data of the previous year they can make a target to expand organisational growth.

- Zero Base Budgeting: It is a method of budgeting which be used by the management of Dell for forecasting. Zero-base budgeting is a budget in which all expenses are justified for each new period. As the name describes itself, it starts from a zero base. Management of Dell can analyse every function which occurs in an organisation after that they can assess the needs and costs involved in it.

3.3 Evaluation of how planning tools respond appropriately to solving problems in the context of Dell, leading to sustainable business development

Various planning tools can be used for responding towards problems which are faced by the management of Dell. As in the given case study management accounting expertise enhances service sales by 10%. sustainability in development is necessary and to achieve sustainable development management of Dell needs to identify various factors which can affect sustainable development. Budgeting and planning tools help the cited entity in the estimation of various issues which are related to its future projects. Budgeting is a process which needs to be done step by step so that proper and effective results can be derived out of budget(Ambe, 2016). Sustainable development is concerned with the creation of ideas and after such creation management needs to identify the best way to achieve that target. Budget allows them to make certain goals and it also provides them the path to achieve those goals and objectives. Various planning tools like variance analysis helps in the comparison of budgeted and actual output so that management can deal with the factors which are responsible for such variances. Some other planning tools which can assist Dell and its management in solving various problems and to achieve sustainable development are as follows :

- Activity-Based Budgeting: it can be defined as a method of budgeting which is actually designed so that the entity which is using this planning tool can bring transparency to its operation(Noordin,2016). It is a method in which revenues generated through some research activities done by Dell can be allotted to that unit of business which is responsible for generating such revenue.

- Target Costing Management: It can be defined as an approach through which the management of Dell can identify the cost of the product life cycle. Through this management can grow functionality and quality as well as they can earn their expected profit. Through which sustainability in development can be made.

- Balanced Score Card: It can be defined as a strategy performance tool through which the cited entity can manage its performance. Through it, management can efficiently respond towards its problems and it can achieve its target of sustainable development.

TASK 4

4.1 Comparison between Dell and Lenovo that how they respond to financial problems

There are certain issues which an organisation faces during the course of business. Budgeting and its techniques help cited entities to respond to various issues which arise during the course of business. Both companies are facing issues like the availability of inadequate finance for the proposed projects. Budgeting helps an entity to allocate its resources in a way so that it can get better returns on its funds hence it needs to use planning tools for the better management of its funds(Otley, 2016). A comparison of Lenovo and Dell's techniques through which they respond to financial problems are mentioned below :

|

Dell |

Lenovo |

|

· The management of Dell is using ratio analysis for analysing their financial statements. · Dell is using Variance analysis to get information about the factors which create gap between budgeted and actual output |

· Management of Lenovo is using fund flow analysis and cash flow analysis for analysing their financial statements. · Lenovo is not using such variances rather they are following traditional methods in comparison of outputs.

|

4.2 Analyse how, in responding to financial problems, management accounting can lead an organisation such as Dell to sustainable success

The financial problems are faced by every organisation in order to give their best products to customers. A financial problem is a situation where money causes worries. To overcome the financial problem it is impossible for the company. The following are some steps Dell company deal with financial problems.

- To identify the underlying problem that causing difficulties - The first step is to overcome with financial problems which are causing the difficulties for Dell to raise funds from different sources(Shields, 2015 ). To cope with these problems the manger has to identify the real sources of financial troubles.

- Create a budget - The company have to prepare a budget on a regular basis that helps them to how to spend the money. This budget will help the company to save their finance and these funds can be utilised in different activities.

- Determine financial priorities - To overcome financial problems the manager of Dell has to determine what are there priorities to spend the money. Setting clear priorities makes it easy to make tough financial decisions.

- Identify small steps where goals can be achieved - The solution to the financial problem is almost reduce the burden on expenses or it may increase the income of employees. If the expenses of the company are reduced then they can easily target the objectives in the stipulated time period.

- Develop the plan to overcome financial problems - The manager has to plan for tackling financial problems(HEYDARPOUR and EBRAHIMI, 2015). The plan should be made on a regular basis so that the company can pay their debts and maintain its cash position of the company.

Review how things are going - Lastly, the manger has to take review of their plans on a monthly basis. It will help the company to deal with the financial problems and the results will get something different to get a different outcome.

CONCLUSION

In this file, it has been mentioned that how budgeting and its techniques can assist the management of Dell to achieve their objectives. Further, this report also contains the advantages and disadvantages of various budgeting techniques are also mentioned in it. Readers can get knowledge through this file about the comparison of techniques which are used by Lenovo and Dell in responding to various financial problems.

REFERENCES

- Kaplan, R. S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

- Renz, D. O., 2016. The Jossey-Bass handbook of nonprofit leadership and management. John Wiley & Sons.

- Tappura, S and et.al., 2015. A management accounting perspective on safety. Safety science. 71. pp.151-159.

- Sulaiman, S., Ramli, A. and Mitchell, F., 2016. What factors drive change in management accounting in Malaysian organisations? Malaysian Accounting Review. 7(1).

- EBRAHIMI, K. A. and MOGHADASPOUR, H., 2015. THE PRESENTATION OF THE CURRENT STANDING OF MANAGEMENT ACCOUNTING IN IRAN.

- Ambe, C. M., 2016. Environmental management accounting in South Africa: Status, challenges and implementation framework.

- Noordin, R., 2016. Strategic management accounting information elements: Malaysian evidence. Asia-Pacific Management Accounting Journal. 4(1).

- Otley, D., 2016. The contingency theory of management accounting and control: 1980-2014. Management accounting research. 31. pp.45-62.

- Shields, M. D., 2015. Established management accounting knowledge. Journal of Management Accounting Research. 27(1). pp.123-132.

Company

Company